Medical cannabis in New Mexico sees record growth in 2017

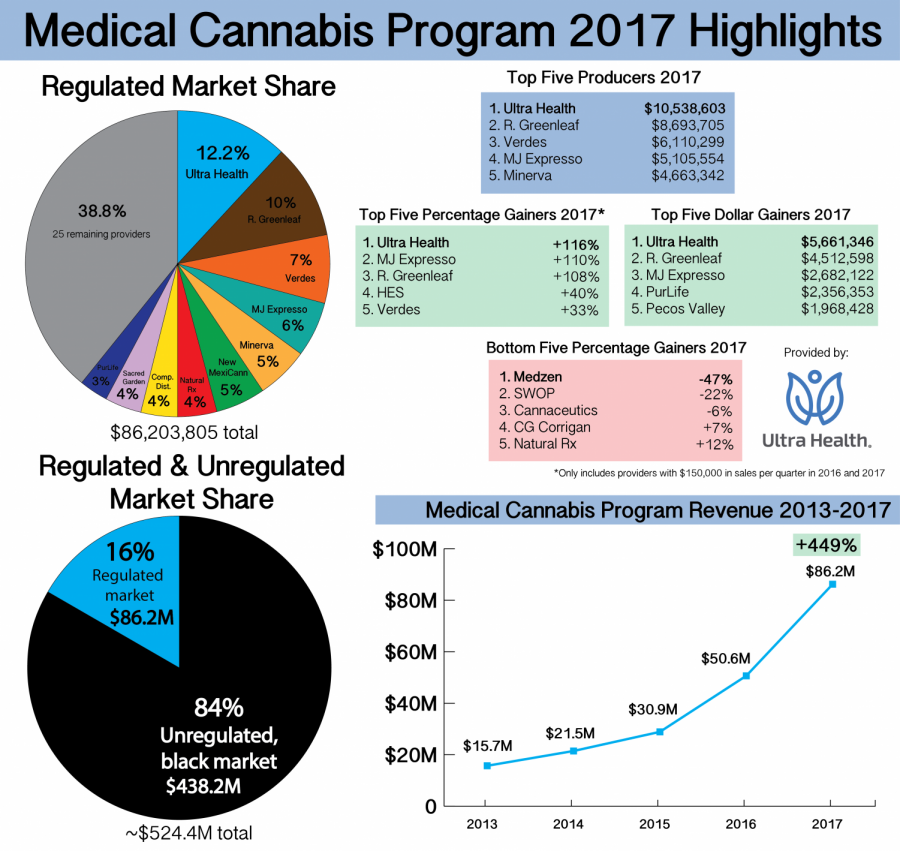

New Mexico finished 2017 with medical cannabis revenues higher than ever before, according to a press release distributed by the state’s top medical cannabis provider. The entire industry grossed $86.2 million in sales, a $35.6 million or 70 percent gain over 2016’s revenue. Patient enrollment in the state has also seen exponential growth, growing by 61 percent from December 31, 2016 to December 31, 2017.

Growth is attributed to “the spirit and resilience of the medical cannabis patients in New Mexico, despite various ongoing challenges to the decade-old program,” the press release states.

These challenges in the medical program include:

- Delays by state officials in issuing cards

- Regulatory limitations on the number of plants a licensed provider can cultivate

- Repeated denials of new qualifying conditions

- Arbitrary patient consumption limits

- Continued delays or refusals by the New Mexico Department of Health to designate new dispensary locations

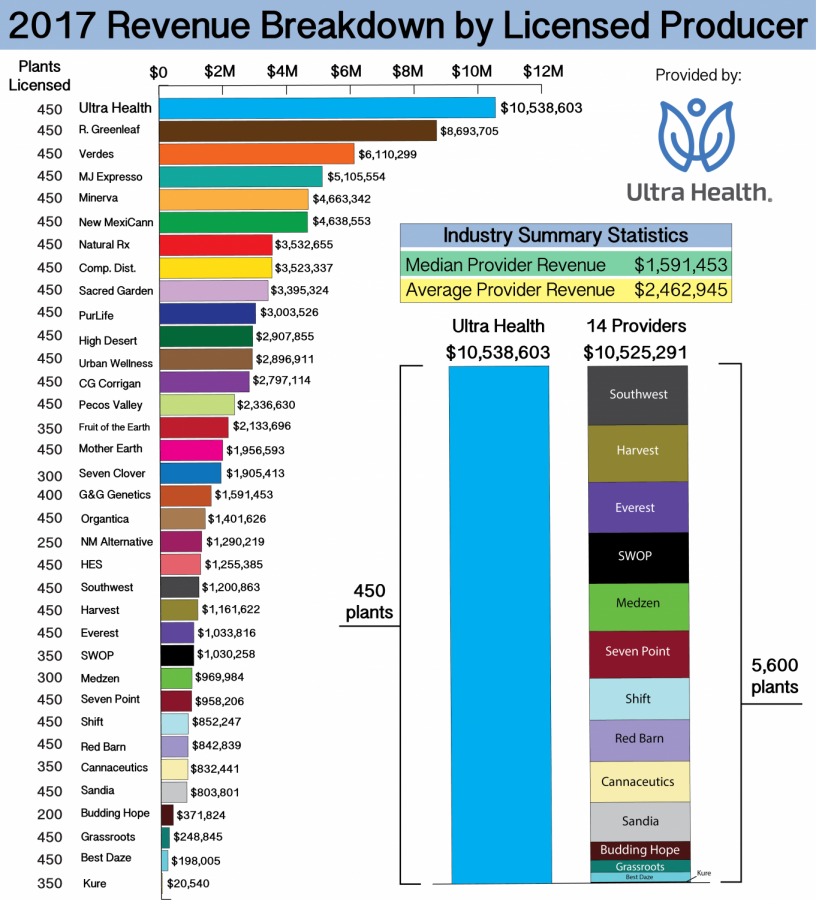

New Mexico has the country’s most strict plant count limit, with a maximum of 450 plants per producer. There are 35 commercial producers in the state, but not all of them license the maximum number of plants allowed due to high fees reaching $90,000 for 450 plants.

“With New Mexico regulators, simple things can be hard, and hard things can be near impossible,” said Duke Rodriguez, CEO and President of Ultra Health® – the state’s top grossing cannabis provider – in the release. “But, the cannabis industry continues to advocate an agenda that puts patients’ needs first. New Mexicans have more than proven their full support to the legal and therapeutic use of cannabis.”

Although the state has the most restrictive plant count, some producers have found ways to stretch the value of each plant. Take a look at the chart below for a breakdown of revenue by each of the 35 producers for 2017.

As you can see, 14 providers combined for $10.5 million in sales with 5,600 plants, while one grossed the same revenue with 450 plants.

During the fourth quarter of 2017, the top five providers in the state accounted for 44 percent of the overall market, signifying consolidation among producers is on the way.

The release goes on to state the total medical cannabis revenue for 2017 was only 16 percent of what is estimated to be the entire cannabis market, both legal and illicit or black market sales. Ultra Health estimates the black market to be valued at $438.2 million.

The medical cannabis company also estimates New Mexico’s revenues or 2018 will surpass $110 million, with patient enrollment reaching 60,000.