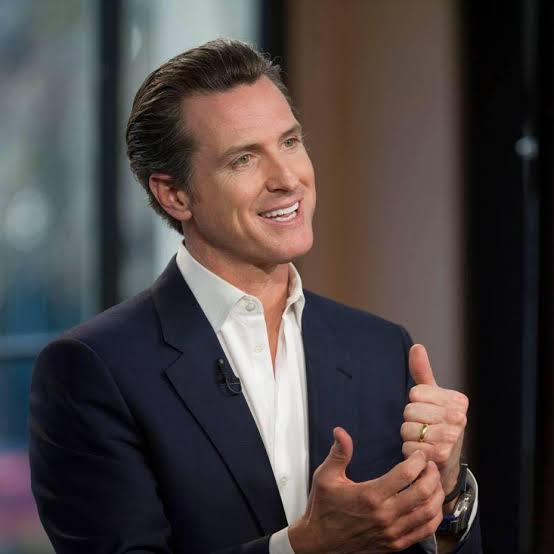

Governor approves California’s cannabis tax fairness bill, dismisses cannabis in hospitals

On Saturday, October 12, California Governor Gavin Newsom (D) revealed that he had signed numerous cannabis-related bills into effect. One of those bills will permit legal cannabis companies to benefit from additional tax deductions.

Up until Gov. Newsom approved of the bill, cannabis cultivators, processors and sellers were not allowed to deduct tax expenses quite like the owners of businesses in other industries are allowed to.

California previously adopted federal law 280E, but based on the terms of AB 37, state-licensed cannabis companies can now deduct taxes. This is thanks to the exclusion of the state tax code from the Internal Revenue Service policy under 280E.

Although Gov. Newsom approved of the cannabis tax fairness bill, he dismissed one that would have enabled select medical cannabis patients in California to use the plant as medicine onsite at hospitals and healthcare facilities.

Terminally ill patients not allowed to use medical cannabis onsite in California’s hospitals

Although he passed a number of bills that will help to bolster California’s cannabis industry, Governor Newsom “begrudgingly” refused to sign SB 305.

This chunk of legislation would have enabled terminally ill patients to use medical cannabis on hospital grounds in certain health care facilities.

Why did Newsom veto the measure? He says that legislation of this kind would cause conflict pertaining to state and federal laws. In his veto message, the governor said that healthcare facilities may lose funding for Medicare and Medicaid if they permit the use of cannabis.

The cannabis plant remains illegal at the federal level; something that Newsom doesn’t take lightly.

“It is inconceivable that the federal government continues to regard cannabis as having no medicinal value. [This] ludicrous stance puts patients and those who care for them in an unconscionable position,” he said.

On the plus side, numerous other developments recently took place after Newsom signed the other measures, including a measure that enables parents of children in California schools to administer medical cannabis to their young on-campus and AB 420, which will prompt research into the cannabis plant’s therapeutic properties and safety of use.

Newsom also signed legislation relating to cultivation canopy sizes, vape cartridge labeling, social equity license applicants, labor peace agreements, marketing and appellations.

California Governor approved medical cannabis for low-income patients

Another bill that was signed by Newsom – who contributed to cannabis legalization by campaigning for the passing of a voter-approved bill in 2016 – was SB 34.

SB 34 permits businesses to grant patients who are on a low income with access to free medical cannabis; products will also be exempt from state taxes.

SB 153 also got a signature from California’s governor. It clearly instructs state officials to prepare an industrial hemp program plan that complies with the 2018 Farm Bill provisions.

The governor requests that the plan be submitted to the U.S. Department of Agriculture for approval.

According to the President of Vote Hemp, Eric Steenstra, California is preparing to become a major contender for other hemp industries around the world thanks to the signing of SB 153.