Report: Thailand’s medical cannabis market won’t reach maturity until 2024

Thailand’s medical cannabis market is gaining some serious momentum. Since the Asian Kingdom legalized the plant for medical purposes in December 2018, numerous developments have been accomplished; exports have been permitted, 442 medical cannabis licenses have been issued among businesses and the first full-time cannabis clinic recently opened its doors.

Despite the success that Thailand’s medical cannabis industry has experienced so far, a mature market may not transpire until 2024. This is according to a report conducted by analysts at Cannabis Catalysts in Vienna.

“Yet, for businesses interested in the Asian cannabis market, there are sound arguments to expand to Thailand,” reads the report, which also predicts that the Southeast Asian country will be worth somewhere between $46 million and $312 million by 2024. However, these valuations are dependent on the legalities of Thailand’s medical cannabis market being straightened out and supply issues being overcome.

“While the basic framework of the cannabis legislation was published soon after the resolution, there is a lack of regulatory specifications up until now. Many aspects of the legal procedures are just not defined yet,” reads an excerpt from the report. “This delays the formation of suitable supply infrastructure. Contrary to the currently insufficient supply of cannabis for medical applications, the demand for therapy is quite high.”

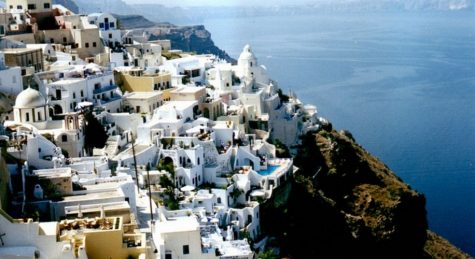

An overview of insights into Thailand’s medical cannabis market in 2024

Based on the estimates contained in the Cannabis Catalysts report, Thailand’s 420 tourism sector could generate $60 million within the next four years. As if that wasn’t exciting enough, medical cannabis exports could harvest more than $618 million, and the ancillary market could be worth between $808 million and $1 billion by 2024.

More Thai residents are expected to become medical cannabis consumers in the near future, what with an amendment to permit home cultivation preparing to be voted on; the measure would enable members of the public to grow no more than six plants for personal medical consumption.Â

So far, 442 licenses have been distributed among lucky business owners in Thailand. Included in the long list of cannabis license holders are 416 distributors, 14 processors/extractors and 12 cultivators.

Commercialization of Thailand’s medical cannabis industry unlikely until 2024

The cannabis plant is referred to as “ganja” – pronounced “kancha” – in Thailand, where it is listed as a class-5 narcotic under the Narcotics Act, B.E. 2522 (1969-79). When medical cannabis legalization was approved on December 26, 2018, Thailand became the first Southeast Asian nation to pass such a law.

Although the country looks set to become a major competitor, the report from Cannabis Catalysts states that full commercialization is unlikely to happen before 2024. Moreover, the analysts believe that private businesses will not be able to participate in Thailand’s medical cannabis market for quite some time yet.

“Private entities can only work in cooperation and under the license of a state-controlled institution, which includes ministries, state agencies, universities and hospitals. Moreover, only companies that are registered in Thailand and owned by Thai citizens to an extent of at least 2/3 are qualified to cooperate with a license holder,” the report reads.

According to the Cannabis Catalysts analysts, private companies interested in growing medicinal-grade cannabis in Thailand must first join forces with a license holder who falls into one of the eligible categories. The company must be fully registered to conduct medical cannabis business practices, as well as have an office that has been registered in the country. Additionally, two-thirds of shareholders, producers and directors must be national Thai citizens.

Prohibiting private companies from obtaining a medical cannabis business license in Thailand is “a protective measure” by the Thai government, say the analysts. The purpose of preventing private businesses from getting involved in the nascent industry is to safeguard state-owned investments from large foreign investors.

Notwithstanding, Thailand’s medical cannabis market has demonstrated significant potential and if things continue the way they have been, the Kingdom might even encourage other Asian countries to enact legalization.